These expenses that would normally be covered by an employer are passed to the independent contractor. In this digital age, technology serves as a reliable compass, guiding you through your financial journey. Cloud-based bookkeeping software offers efficient financial management and reduces errors for independent contractors. This separation facilitates transparent tracking of income and expenses, ensuring smooth sailing when preparing for the tax season.

Shannon Ongaro is a content marketing manager and trained journalist with over a decade of experience producing content that supports franchisees, small businesses, and global enterprises. Over the years, she’s covered topics such as payroll, HR tech, workplace culture, and more. At Deel, Shannon specializes Mental Health Billing in thought leadership and global payroll content.

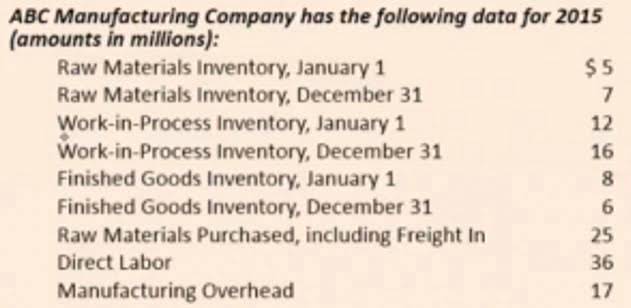

But freelancers have unique bookkeeping needs that don’t always apply to other small-business owners, especially in terms of tax obligations. LYFE Accounting has extensive experience in servicing independent contractors. We manage books, file tax returns and project and budget future sales and expenses. We possess the capacity to service your company’s financial needs. In general, an individual or business is considered an independent contractor if they provide products or services under either a written contract or verbal agreement.

From meticulous expense tracking to strategic tax planning, we’re here to streamline your financial processes, ensuring accuracy and compliance. Reviewing your books regularly is important to stay on top of your bookkeeping. This may include reviewing financial reports, reconciling bank accounts, and monitoring cash flow. Regular reviews of your books can help you stay organized and make informed financial decisions for your business. As independent contractors need accounting software, it is important to choose with careful consideration. Although, we also provide a list of some of the best accounting software for small businesses or for independent contractors.

For more information about HashMicro’s Accounting Software, you can contact us here. This allows you to manage cash flow and profitability effectively. Additionally, tracking all income, especially through client payments noted on Form 1099-MISC, is necessary for complete and accurate tax filings.

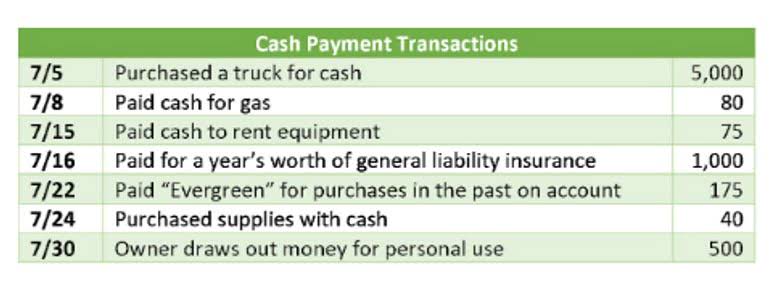

Notices shall be deemed received on the day of delivery if sent by hand or courier service or on the third business day after the date of posting if sent by registered mail. The Accountant shall be solely responsible for complying with all applicable laws, rules, and regulations in performing their obligations under this Agreement. The Client shall pay the Accountant for the actual number of hours worked by the Accountant at the hourly rate of . So does this mean I don’t think you should ever hire employees? The number of freelancers worldwide has reached around 1.5 billion as workers seek more creative control and financial independence.

Our accounting services are designed and centered around your type of business. Whether you’re a business owner with multiple team members or are a sole proprietor, we specialize in servicing independent contractors with all of your accounting needs. Having organized and up-to-date financial records ensures timely invoicing, on-time bill payments, meeting tax obligations, and making sound business decisions. It’s like having a vigilant lookout, always keeping an eye on the horizon to guide your way. https://theartisanhub.co.uk/bookkeeping/airbnb-accounting-best-practices-for-hosts/ By linking your bank account directly with your accounting software, you can automate the reconciliation of bank transactions, streamlining your bookkeeping process.

Accounting software helps you calculate your tax estimates and makes it easy to reconcile your bank transactions. When tracking expenses, the IRS considers a business expense anything necessary and ordinary to the business. Independent contractors are considered a single-member limited liability company (LLC) or a sole proprietor for tax purposes.

At Less Accounting, we simplify your finances with expert bookkeeping and historical cleanup, giving you the clarity you need to succeed. Shoeboxed has a mileage tracking feature that logs business trips so you can claim mileage deductions. Contacts can also be exported as CSV files and independent contractor bookkeeping imported into other contact management systems or email clients. All digitized business cards are stored in a central cloud-based database, making contact information accessible anywhere. Independent contractors are responsible for everything since they are the sole business owner. This will separate your business transactions from your personal expenses.